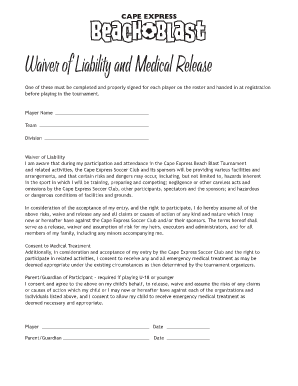

CA KLM Landscaping Company Profit & Loss Statement (Sample Only) 2010-2026 free printable template

Show details

PROFIT LOSS STATEMENT Sample Only KLM Landscaping Company 201 Third St San Francisco CA 94103 415 555 5555 Must include address and phone Must include month and year January 2009 February 2009 March 2009 Total Income 5 000 Expenses Car 200 Equipment 1 000 Repair 300 Advertising 300 Depreciation 100 Meals Entertain. 100 Cash Draw 1 000 Total Expenses 3 000 Total...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign lawn care business expenses spreadsheet form

Edit your profit and loss statement for landscaping business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your landscaping profit and loss statement example form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing landscaping profit and loss statement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit where can i find a profit and loss statement template for a landscaping business form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out landscaping expense accounting form

How to fill out CA KLM Landscaping Company Profit & Loss

01

Gather all financial documents related to income and expenses.

02

Identify and categorize all revenue streams specific to the landscaping services offered.

03

List all direct costs associated with providing landscaping services, such as materials and labor.

04

Include indirect costs, such as overhead expenses (utilities, rent, salaries).

05

Calculate gross profit by subtracting total direct costs from total revenue.

06

Calculate total operating expenses by adding indirect costs.

07

Subtract operating expenses from gross profit to determine net profit or loss.

08

Review and verify all entries for accuracy.

09

Complete the profit and loss form by transferring the totals to the designated sections.

Who needs CA KLM Landscaping Company Profit & Loss?

01

Business owners and managers of CA KLM Landscaping Company.

02

Accountants or financial analysts involved in financial reporting.

03

Investors evaluating the company's financial performance.

04

Tax professionals preparing taxes for the landscaping company.

05

Stakeholders or partners interested in the company's profit health.

Fill

landscaping chart of accounts template

: Try Risk Free

People Also Ask about people also ask about lawn marketing your business

How do I create a spreadsheet for my business expenses?

How Do You Create an Expense Sheet? Choose a template or expense-tracking software. Edit the columns and categories (such as rent or mileage) as needed. Add itemized expenses with costs. Add up the total. Attach or save your corresponding receipts. Print or email the report.

What are the expenses of a lawn mowing business?

Most lawn care businesses typically range from $5,000 - $8,000 in order to get started (not including the total price of a truck). When planning your business, you may want to consider the following types of cost: Business structure. Marketing your business.

How do I write a business plan for a lawn care business?

How To Create A Lawn Care Business Plan Understand What A Business Plan Is. A business plan is a roadmap for your business. Estimate Your Startup Costs. Establish Your Initial Service Offerings. Run a Market Analysis. Determine Your Pricing Strategy. Implement Effective Marketing Strategies. Create a Financial Plan.

How do I start a landscaping business plan?

How to start a landscaping business in 5 steps Decide what services you want to offer and whether you want to rent or buy equipment. Get the required business insurance, licenses and EIN. Get employment law liability insurance before you scale. Develop a marketing plan and decide on prices.

How do I set up a business plan for a lawn care business?

How To Create A Lawn Care Business Plan Understand What A Business Plan Is. A business plan is a roadmap for your business. Estimate Your Startup Costs. Establish Your Initial Service Offerings. Run a Market Analysis. Determine Your Pricing Strategy. Implement Effective Marketing Strategies. Create a Financial Plan.

What can I write off as a lawn care business?

Nine tax deductions for a lawn care business Travel expenses. Advertising. Insurance. Vehicle and equipment maintenance. Equipment rental or lease. Home office. Contractor expenses and employee wages. Legal and professional services.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my what can i write off legal and professional services directly from Gmail?

lawn care spreadsheet and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I fill out the landscaping business forms form on my smartphone?

Use the pdfFiller mobile app to fill out and sign landscaping business profit loss statement template on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I fill out lawn care companies accounting on an Android device?

Use the pdfFiller mobile app to complete your accounting for lawn care business on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is CA KLM Landscaping Company Profit & Loss?

CA KLM Landscaping Company's Profit & Loss statement is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period, illustrating the company's ability to generate profit or report losses.

Who is required to file CA KLM Landscaping Company Profit & Loss?

Typically, businesses including CA KLM Landscaping Company, must file a Profit & Loss statement for tax purposes, investors, and financial reporting to comply with accounting standards.

How to fill out CA KLM Landscaping Company Profit & Loss?

To fill out the Profit & Loss statement, start by listing all sources of revenue, followed by subtracting the total expenses and costs of goods sold from total revenue to calculate net profit or loss.

What is the purpose of CA KLM Landscaping Company Profit & Loss?

The purpose of the Profit & Loss statement is to provide a clear overview of the company's financial performance over a specific period and inform management and stakeholders about profitability trends.

What information must be reported on CA KLM Landscaping Company Profit & Loss?

The Profit & Loss statement must report total revenues, cost of goods sold, gross profit, operating expenses, taxes, and net profit or loss to give a comprehensive view of financial performance.

Fill out your CA KLM Landscaping Company Profit Loss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Landscaping Business Expenses List is not the form you're looking for?Search for another form here.

Keywords relevant to landscaping report

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.