CA KLM Landscaping Company Profit & Loss Statement (Sample Only) 2010-2024 free printable template

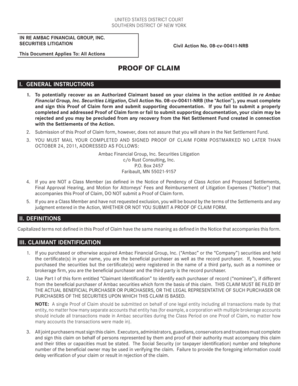

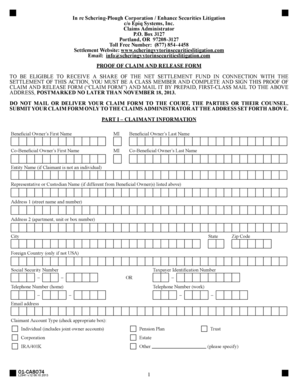

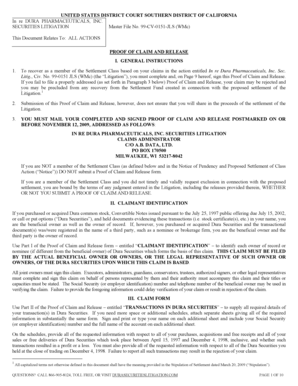

Get, Create, Make and Sign

Editing lawn care business expenses spreadsheet online

How to fill out lawn care business expenses

How to Fill Out Lawn Care Business Expenses:

Who Needs Lawn Care Business Expenses:

Video instructions and help with filling out and completing lawn care business expenses spreadsheet

Instructions and Help about landscaping profit and loss statement form

Hello friends welcome back to bank exams today rod count today we will do important chapter that is profit andlossso profit and loss chapter involves various terms like cash prize selling price mark fries profit and loss sophist of all let me explain to you what is profit cost selling price etc, etc so for example you own a shop you have a shop you are running the shop stationery shop, and you bought a pen from the wholesaler for a piece 10 you bought a pen from a wholesaler for rupees 10, so that is your cost price so rupees 10 is your cost price now you#39;reselling one piece of pen for piece 12now rupees twelve is your selling price and that rupees two is your margin and that is your profit so the formula Roget profit is equal to selling price SP minus cos price so for example you bought a Ben ford rupees ten, but nobody is ready to buy this for twelve rupees so now to clear your funds to maintain the flow of your working capital you reselling it for rupees eight instead of rupees 12 now the selling price will bless than the car the selling price Willie less than the cost price, and you will incur the loss so the formula to calculate the losses also the same so in case of profit the selling price minus cost price the selling price was twelve and the cost price was ten you got profit of rupees two so in case of loss the selling price is rupees eight and the cost price is rupees ten and therein a loss of rupees two and whenever there is a negative sign in this formula there will be a loss so in case of profit that is the case of profit it#39;sin positive so in case of loss the outcome will be negative when we deduct cost rise from the selling price there will be an outcome will be negatives there will be a loss now I will explain to you how to calculate the profit percentages as same in the previous example the cost prices rupees 10 and the selling price is rupees 12 the profit is rupees — you can remember that profit is equal to selling price minus cos price is equal to profit now to calculate the profit percentage the profit percentage or gain percentage the formula to get the profit percentages profit divided by cos price multiplied by 100 now the profit is rupees 2 and the selling price is rupees10 and multiplied it by 100 now you will the profit percentages 20% in case floss if you want to calculate the loss percentage so for example the selling price the selling price is rupees 8instead of rupees 12 it is rupees 8 now you are incurring loss of rupees 2 sophists of all let#39’s calculate the loss is rupees 2 selling price minus cost price is equal to loss it will be negative, so it would be loss the loss percentage will be loss divided by cos price multiplied by 100similarly the loss is rupees 2 the selling price is rupees 10 and multiplied it by 100 then you will get20% as a loss percentage now we will do some simple quotients dishonest dealer sells his goods at cause, but he uses 960 gram weight for 1 kg what is his profit percentage so...

Fill lawn care pricing spreadsheet : Try Risk Free

People Also Ask about lawn care business expenses spreadsheet

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your lawn care business expenses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.